By: Stephanie Schils | July 8, 2024 (5 min read)

The proliferation of Exchange Traded Funds (ETFs) has asset and wealth managers of all sizes asking themselves what their future role could, or should, be within the ETF industry. To remain competitive, it’s an increasingly important question to answer.

After reading this guide you’ll understand (1) the drivers of ETF growth and competitive landscape, (2) why a manager should consider launching an ETF(s) as a strategic opportunity to position themselves for future growth, and (3) a framework for how to get started.

Let’s begin…

1. WHAT drives ETF industry growth?

The answer lies in the evolution of both ETF product availability and adoption, driven by the increasing recognition of three foundational benefits of the ETF wrapper:

- Daily Transparency into portfolio holdings1

- Intraday Liquidity given ETFs trade on an exchange

- Potential Tax Efficiency by minimizing fund-level capital gains distributions through the in-kind exchange of securities in the creation and redemption of ETF shares.

ETFs began as a low-cost investment tool to replicate simple, market cap-weighted index exposures, but have evolved to capture incremental degrees of alpha (relative to the broad market). Availability and adoption of alternatively weighted and customized, systematic index-tracking ETFs followed, redefining the explicit association between ETFs and purely passive investing. Now ETFs also deliver traditional actively managed strategies.

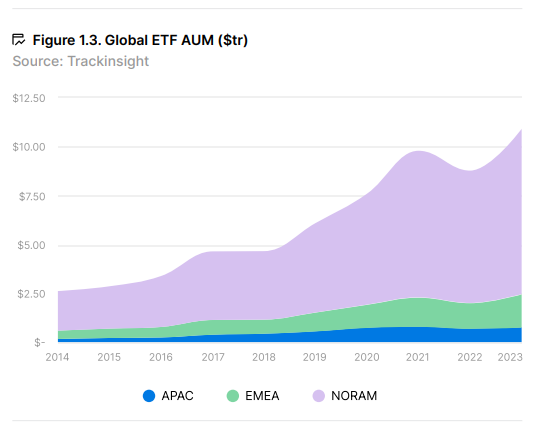

The Global ETF industry has delivered a 5-year compound annual growth rate of 19% to reach USD 11 trillion in assets by year-end 2023. Assets grew by more than 25% in 2023 alone and exceeded USD 12 trillion by June 2024.2

Expectations for asset gathering remain high as greater recognition of the wrapper’s structural benefits coincides with an increasing number of managers expanding the industry’s product offering, now at over 10,000 ETFs globally3. These dynamics, paired with trending outflows in mutual fund assets in 8 of the last 10 years in the U.S.4, set the stage for future growth.

ETF industry survey results reinforce future growth expectations:

- Global ETF AUM is predicted to reach at least $19.2 trillion by 2028, with the US continuing to account for over 70% of global assets, according to PWC.5

- Within Europe, Ernst & Young expects ETF growth to continue at 15% annually for the next five years and reach over $4.5 trillion AUM by 2030.6

- Among Brown Brothers & Harriman 2024 Global ETF Survey participants, 82% intend to increase their ETF use, up from 61% in 2023. In the US, the intention to increase ETF usage was highest at 97% compared to 74% in Europe, and 77% in Greater China.7

COMPETITIVE INDUSTRY LANDSCAPE

A growing ETF industry represents opportunity. It also results in increased competition as more managers look to capture their share of the market’s expansion.

In an industry where a first-mover advantage at the product level and economies-of-scale at the platform level play an outsized role in gaining market share, ETF assets have been highly concentrated among the “Big Three” (BlackRock, StateStreet, and Vanguard) historically, representing 75% of ETF AUM in North America. Beyond their reach, the top ten issuers capture 90% of the market, and the top twenty account for 96% of total ETF AUM (as of 12/31/23).1

Beyond the “Big Three”, ETF managers found their niche by focusing on a specific structure, innovative exposure, style, region, or asset class; for example, inverse/levered, thematic, factors, Asian equities or commodities.

Other managers desiring to participate in the industry remained on the sidelines because:

- There was no economic incentive due to the dollar investment needed to compete at scale with dominant ETF issuers,

- Their investment capabilities skewed toward active management instead of a systematic, indexed approach, therefore…

- The ability to showcase their differentiated investment strengths amidst a growing number of available ETFs was limited.

THE RISE OF ACTIVE ETFS

Previously, managers wanting to launch an ETF were required to file for exemptive relief with the SEC for the ETFs to operate under the Investment Company Act of 1940, adding cost and extending the time taken for review and approval.

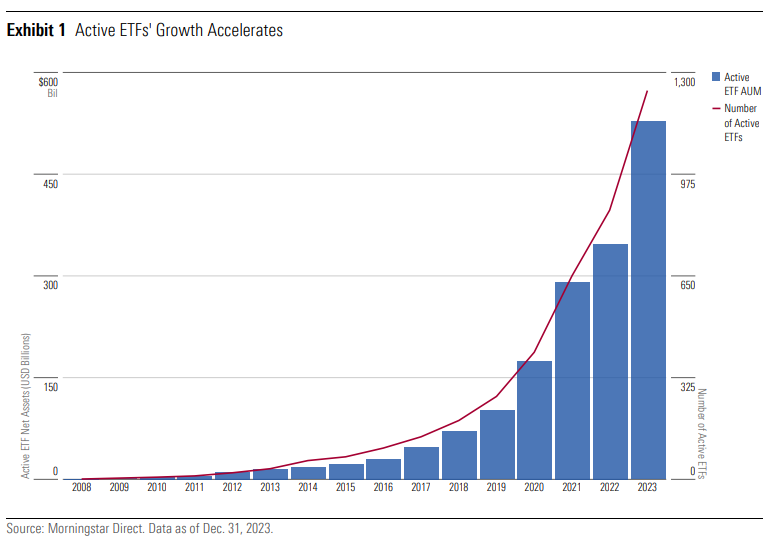

In 2019, the ETF Rule (also known as Rule 6c-11) was passed by the SEC to create a consistent, transparent, and efficient regulatory framework for ETFs. It reduced the barriers to entry for issuers in both time-to-market and filing costs by eliminating the need to file for exemptive relief.

The Rule catalyzed growth in actively managed ETFs, enabling previously sidelined managers to more seamlessly enter the market, as long as their ETFs meet a specific set of requirements. Some of these include full daily transparency into portfolio holdings and website data disclosure requirements across portfolio holdings and secondary market trading characteristics. They also allow for custom ETF share creation & redemption orders to deviate from the exact portfolio composition.8

Representing only 2%+ of the total US ETF market in 2019, active ETFs have since grown to USD 530 billion in assets, or 7% of the US ETF industry at the end of 2023, exceeding 20% organic growth per year over the period. 4 Active ETFs assets reached $690bn across in the US as of June 2024.9 Albeit much smaller in size, Europe (EMEA) has also seen an uptick in active ETF assets sitting at $41bn as of June 2024.1

Over 70% of ETFs launched in the US in 2023 were active5 (373 new active ETFs, 57 new active ETF issuers).In the first 4 months alone of 2024, there were 24 new ETF issuers across 124 new active ETFs listed on NYSE.10

2. WHY offer ETFs: Benefits to Managers

MANAGERS BENEFIT BY OFFERING ETFS IN THREE KEY WAYS:

- Expand reach across client segments

- ETFs are directly and easily accessible investment instruments used by individual, intermediary, and institutional client bases.

- Diversify how clients access investment capabilities

- How and why an investor allocates with a given investment vehicle varies based on its characteristics, like exposure, cost, and liquidity.

- Offering ETFs diversifies the use cases for a manager’s strategy to be used in the portfolio construction process, whether it be as a tactical, strategic, or trading instrument.

- Evolve with the asset management industry

- Position the product platform to benefit from the industry shift in investor preferences increasingly toward ETFs.

EXISTENTIAL QUESTIONS THAT MANAGERS ARE ASKING THEMSELVES:

While the answer to these questions will vary by firm and its unique circumstances, managers should consider these perspectives.

- Am I reactively being pulled into the industry out of necessity to “evolve with the times” or am I proactively “innovating” to build an ETF platform?

- More managers likely feel they are being pulled into the industry and are researching which approach best aligns with their objectives to determine if, how, and when they move forward with ETFs.

- Why should I offer ETFs when my mutual fund platform generates more revenue?

- ETFs, both active and passive, are increasingly used as allocation tools by investors. Consider offering ETFs as an investment in the firm’s platform for current and future competitiveness as other managers do the same. Increase cross-selling opportunities to deepen existing client engagement with ETFs.

- What is the risk if I don’t offer ETFs over the short-term and long-term?

- Consider the impact on flows, revenue, and the ability to compete. As industry product offerings expand, investors are not only comparing mutual funds to mutual funds, but also mutual funds to ETFs as the appropriate implementation tool for them.

- Are ETFs where I want to invest my resources to innovate or are there other product capabilities that are a greater priority?

- Consider the product segments with greatest industry growth. Assess the dollar investment needed to develop competitive capabilities in the product segment, inflows and time horizon to break even, and future long-term growth potential.

The answer to these questions will impact the resources, infrastructure, budget, and approach a manager takes to offering ETFs.

3. HOW to enter the ETF Market: Key Considerations

ASSESS YOUR INTERNAL INFRASTRUCTURE CAPABILITIES:

- Determine existing internal capabilities and operational infrastructure needs. Consider that ETFs have certain unique requirements (relative to mutual funds), particularly in the ETF share creation and redemption process.

- Launching an ETF requires collaboration across product (strategy), distribution, marketing, legal/compliance (regulatory), investment team, capital markets, technology (back-end integration and build-out for risk systems, create/redeem data, website data feeds), fund admin/custody, operations.

- In which functions are existing resources available to dedicate to ETF efforts?

PARTNER EXTERNALLY OR BUILD IN-HOUSE:

- Which approach best supports your business model/strategy?

- What are the associated costs in time, resources, and dollars?

- Develop infrastructure internally

- Determine costs, hiring needs, prioritization relative to other initiatives, and who from each functional team will be the go-to for ETF support/questions.

- Outsource to whitelabel provider

- Assess the differences in the offering of whitelabel providers, TAMPs/ETF service providers and which align with the areas of support needed. For example, regulatory/compliance, fund administration and custody, trust/fund board set-up, capital markets, seed capital sourcing, portfolio trading, marketing and distribution support.

UNIQUE EDGE:

- What strengths are you leaning into through your investment strategy?

- In which product segments can you best compete through a differentiated investment approach or exposure, strong performance history, or competitive pricing?

- Which strategies are best suited for investment via an ETF? Consider that ETFs cannot be gated to inflows/outflows.

PATH TO $100 MILLION:

- Can you clearly identify the fundraising path or strategy to reach the first $100mn in AUM?

- Consider the typical fundraising cycle beginning with (1) retail/individuals to (2) registered investment advisors / family offices, (3) wirehouses/banks, and (4) institutions

- For new ETFs, the RIA segment (and family offices) are a fundraising sweet spot given the greater flexibility with minimum AUM or track record to allocate. Increasingly though, the individual investor plays an important role in driving ETF flows through direct or digital investing platforms.

- Individuals have accounted for elevated US-listed ETF trading volume since 2019 ($2 trillion), reaching over $5 trillion in 2023. Within US-listed active ETFs, individual investors accounted for over 30% of all actively managed ETF volumes in 2023, up from 24% in 2022.11

- In which client channels do you have the strongest coverage and relationships?

- How is your distribution team incentivized to prioritize fundraising for your ETFs?

- How is marketing engaged to support your distribution efforts?

Footnotes:

- Only applicable to fully transparent ETFs. Does not apply to semi-transparent ETFs, which have varying frequency and degrees of portfolio holdings disclosure. ↩︎

- Trackinsight, “2024 Global ETF Survey”, figures in USD. ↩︎

- ETFGI, June 2024, “ETFGI reports assets invested in the Global ETFs industry reached a new record high of US$12.89 trillion at the end of May” ↩︎

- “Morningstar’s Guide to US Active ETFs: Observation and Analysis of Key Active ETF Trends” ↩︎

- PWC, “ETFs 2028: Shaping the Future”, results as of 2023. PwC surveyed more than 70 executives from around the world in 2023, using a structured questionnaire. Over 80% of the participants were exchange-traded fund (ETF) managers or sponsors. The remaining participants were made up of service providers, market makers and other asset managers. ↩︎

- Ernst & Young, “European ETF market forecast to grow 15% annually over next 5 years, reaching $4.5trn by 2030”, March 1, 2024 ↩︎

- Brown Brothers Harriman, “2024 Global ETF Investor Survey”, survey includes 325 ETF investors across institutional investors, financial advisors and fund managers across the U.S., Europe (including the U.K.), and Greater China. 40% manage more than $1 billion in assets. ↩︎

- SEC, “SEC Adopts New Rule to Modernize Regulation of Exchange-Traded Funds” ↩︎

- ETF.com, Active Management ETFs ↩︎

- NYSE, Active ETF Stat Pack April 2024 ↩︎

- BlackRock, “Global ETF Market Facts: three things to know from Q4 2023”. As of November 30, 2023. BlackRock analysis of SEC Rule 605 data. ↩︎