The WHAT, WHY, and HOW of Entering the ETF Business. After reading this guide you’ll understand (1) the drivers of ETF growth and competitive landscape, (2) why a manager should consider launching ETF(s) as a strategic opportunity to position themselves for future growth, and (3) a framework for how to get started.

It was a pleasure to make a guest appearance on the We Talk Careers Podcast at the Women in ETFs 10-year anniversary event…very appropriately discussing how to network with intention! Thank you to Kristine Delano for driving the conversation! Four thoughts I shared on how to maximize networking events: 1. Take advantage of the INTELLECTUAL […]

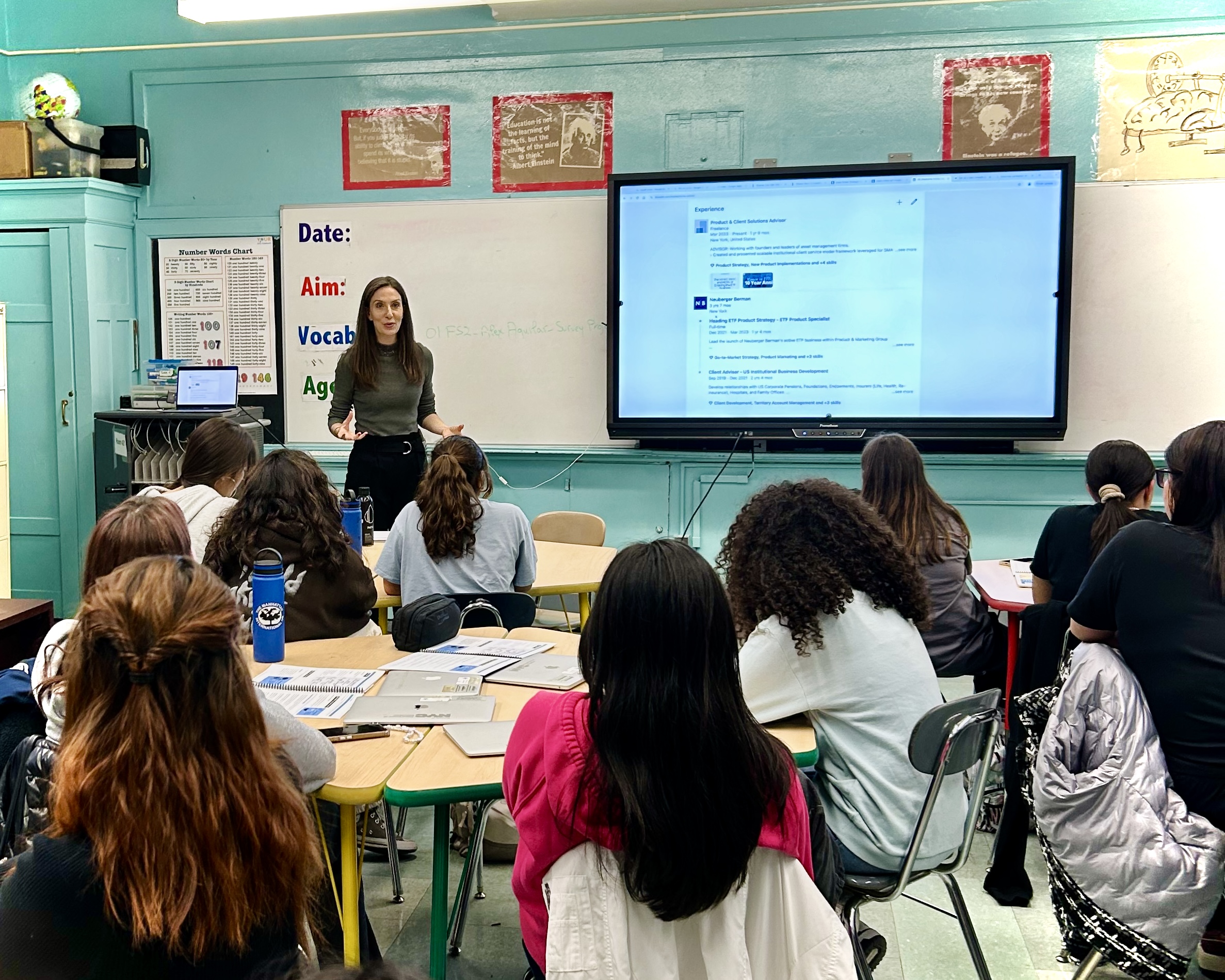

It was fun to support fellow BlackRock Alum, Kristen Castell, and the amazing work she’s doing at the Center for Accelerating Financial Equity (CAFE) with companies building financial inclusivity solutions. Three themes emerged during the discussion as a basis for improving financial outcomes: (1) potential tax efficiency, (2) increased transparency, and (3) managing costs. Within […]

It was a pleasure to connect with fellow George Washington University alum, Christine Brown-Quinn, and together attend the International Women’s Forum’s UK Autumn Reception in London with Dr Grace Lordan as the keynote speaker! Christine is an accomplished finance industry veteran, author, founder of The Female Capitalist, and member of the Board of Advisors for […]

It was a pleasure to meet peers across the European ETF industry in London at the Women in ETFs event hosted by J.P. Morgan Asset Management. The first panel, “From the Podium to the City” included former professional athletes who spoke about the skills and lessons learned through both individual and team competition and how […]

Disclosures:

Certain products and services may not be available in all jurisdictions or to all client types. This material is provided for informational and general investment education purposes only and nothing herein constitutes investment, legal, accounting, or tax advice, or a recommendation to buy, sell, or hold a security.

This material is general in nature and is not directed to any category of investors, and should not be regarded as individualized, a recommendation, investment advice or a suggestion to engage in or refrain from any investment-related course of action. Investment decisions and the appropriateness of this material should be made based on an investor’s individual objective and circumstances and in consultation with his or her advisors. If you are an individual retirement investor, contact your financial advisor or other fiduciary about whether any given investment idea, strategy, product or service described herein may be appropriate for your circumstances.

Information is obtained from sources deemed reliable, but there is no representation or warranty as to its accuracy, completeness or reliability. All information is current as of the date of this material and is subject to change without notice. Any views or opinions expressed are subject to change. This material may include estimates, outlooks, projections or other “forward-looking statements." Diversification does not guarantee profit or protect against loss in declining markets. Investing entails risks, including possible loss of principal. Indexes are unmanaged and are not available for direct investments. Past performance is no guarantee of future results.

INFORMATION AND EXAMPLES PRESENTED ARE INTENDED FOR SOLEY EDUCATIONAL AND ILLUSTRATIVE PURPOSES. NOTHING HEREIN IS INTENDED TO PREDICT FUTURE PERFORMANCE OR OUTCOMES OF ANY PRODUCT. AS WITH ALL FUNDS, ACTIVE AND PASSIVE ETFS HAVE DIFFERENT RISK PROFILES, FEES AND EXPENSES. IT IS IMPORTANT TO READ A FUND’S OFFERING DOCUMENTS BEFORE INVESTING.

An investor should consider each Fund’s investment objectives, risks, fees and expenses carefully before investing. This and other important information can be found in each Fund’s prospects or summary prospectus, which you can obtain by visiting the Fund page on the fund manager’s website. Please read the prospectus of summary prospectus carefully before making an investment.

All ETF products are subject to risk, including possible loss of principal. Unlike mutual funds, ETF shares are purchased and sold in secondary market transactions at negotiated market prices rather than at net asset value (“NAV”) and as such ETFs may trade at a premium or discount to their NAV. As a result, shareholders may pay more than NAV when purchasing shares and receive less than NAV when selling shares. ETF shares may only be redeemed at NAV by authorized participants in large creation units. There can be no guarantee that an active trading market for shares will develop or be maintained or that the ETF’s shares will continue to be listed. The trading of shares may incur brokerage commissions. ETFs have a limited number of Authorized Participants. To the extent they exit the business or are otherwise unable to proceed in creation and redemption transactions and no other Authorized Participant is able to step forward to create or redeem, shares may be more likely to trade at a premium or discount to NAV and possible face trading halts or delisting. Unexpected episodes of illiquidity, including due to market factors, instrument or issuer-specific factors and/or unanticipated outflows, could have a significant negative impact on the ETF’s NAV, liquidity, and brokerage costs. To the extent the ETF’s investments trade in markets that are closed when the ETF is open, premiums or discounts to NAV may develop in share prices.